Counterparty Risk System Select

Undertaking counterparty risk system selections can often be a time consuming process for financial institutions. Understanding the counterparty risk technology landscape of market vendors, the strengths and weaknesses of each particular vendor and the costs involved in implementation and ongoing support can often be a complex and confusing task.

Systems selection processes may be undertaken as part of a wider Counterparty Risk Solution Definition exercise, or as a standalone Request for Information (RFI)/Request for Proposal (RFP) process.

The InteDelta Counterparty Risk System Select tool has been developed to enable our clients to identify the most appropriate counterparty risk system in optimal timeframes. This comprises of a pre-configured tool which we use to score counterparty risk systems.

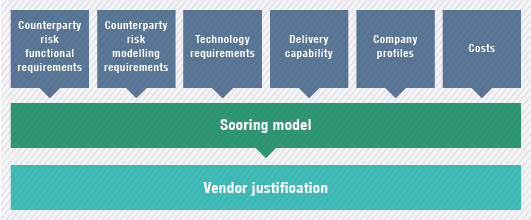

The diagram below shows the primary components of the Counterparty Risk System Select tool.

This can also be easily extended to incorporate a client’s particular requirements.

The vendor justification step in the process provides a summary of the selection and scoring process which can then be used for management approval and/or communication of the basis for the selection decision.