Counterparty Risk Benefit Assessor

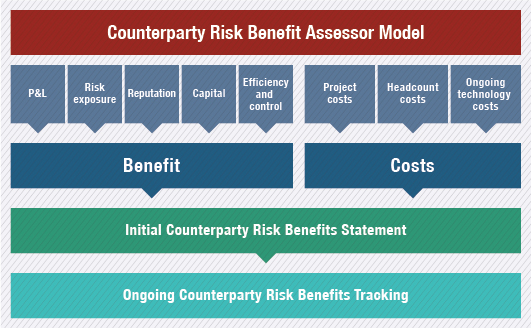

Our Counterparty Risk Benefit Assessor tool is used to assess the benefits and associated costs of any counterparty risk initiative. We have a pre-configured tool for this purpose, but this may also be built out to meet a client’s particular requirements. The diagram below shows the primary components of our Counterparty Risk Benefit Assessor:

For each of the areas covered we have developed a range of metrics to assess the benefits and costs arising from the proposed programme of work:

| Area | Metrics |

|---|---|

| View full table | |

| P&L |

|

| Risk exposure | Expected change in counterparty credit risk exposures as a result of improvements to be made to the counterparty risk process |

| Capital | Expected change in client’s economic and/or regulatory capital through more sophisticated counterparty risk modelling |

| Efficiency and control | Efficiency and control benefits to be gained from automation and or rationalisation of the end to end counterparty risk management process. e.g. in rationalisation of counterparty risk limit structures |

| Reputation |

This is a more judgemental area in which we assess the likely impact on the client’s reputation from the perspective of:

|

| Project costs | We have standard project cost estimations for counterparty risk projects based upon previous work. These can be used as a starting point and be built out for each client specific initiative |

| Ongoing technology costs | We have standard ongoing technology cost estimations for counterparty risk infrastructure based upon previous work. These can be used as a starting point and be built out for each client specific initiative |

| Headcount costs | We have a headcount model for the estimation of the ongoing incremental business headcount which can be expected to arise from any process change |